Simplifying Third-Party Insurance Verification: How to Improve Communication, Compliance & Conversion

Nearly 25% of all third-party proof of insurance requests go unanswered. Why? There are many contributing factors, but the primary reasons are due to a lack of automation, digitization, and communication. The entire insurance ecosystem has traditionally relied on individuals to manually produce, transmit, extract, and analyze proof of insurance data, which creates a labor-intensive, error-prone verification process for all. Couple this with unclear communication of requirements, insufficient processes for supporting and managing third-party relationships, and an overall lack of adherence to outreach best practices at the enterprise level, and you’ve got yourself a recipe for failure. But fear not! Insurance verification should be supporting your business, not slowing it down, so let us help you uncomplicate it.

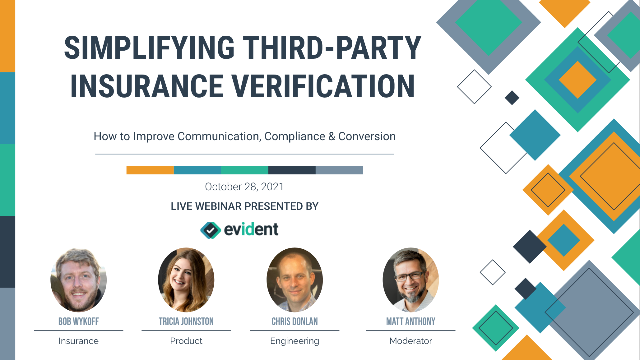

In this webinar, Evident’s panel of experts will discuss tips and best practices for automating tedious verification processes and engaging your Insureds to improve conversion rates, reduce risk, and boost compliance levels.

Presented by

Presented by